CVCS Excellence Fund

The CVCS Excellence Fund

Our goal at Cole Valley Christian Schools is to shepherd and challenge students to their individual potential with exceptional educational experiences that are Christ-centered and biblically infused.

But we can’t do it alone!

Every Gift Matters, No Matter the Size

STAFF BOARD ALUMNI FAMILIES COMMUNITY

That’s where YOU come in! The CVCS experience is possible because of generous gifts from our alumni, friends, and members of the community. With your help, we can continue our tradition of equipping students with the knowledge and abilities to be leaders and to impact the world for Christ.

We aim for all of our constituents to partner with our mission through the Excellence Fund. As a high percent of our current STAFF, BOARD, all GRADUATES, and FAMILIES invest in our Excellence Fund, it shows our collective commitment to the mission of CVCS to the world and attracts others to give along with us.

Show your belief in our MISSION to the world.

Invest in the legacy of CVCS.

Welcome to the place where the most loyal to Cole Valley choose to hang their hats. You’re in great company.

While all unrestricted giving supports deserving students and world-class faculty, your LEGACY GUILD membership provides the school with valuable security, consistency, and the foundation it needs to face both challenge and opportunity. When you make your financial commitment at any of the following Legacy Guild Membership levels, you will become a part of our guild for recognition, communication, and celebration.

Legacy Guild Memberships:

- Royal Guild: $20,000 + / year

- Silver Guild: $15,000 - $19,999 / year

- Founder's Guild: $10,000 - $14,999 / year

- Fellowship Guild: $2,500 - $9,999 / year

Membership Benefits:

An annual reception with the Superintendent and School Board is held to recognize and celebrate the impact of our Legacy Guilds' investments at CVCS.

Guild Members also receive 2 tickets to our annual Legacy Gala and recognition at the event as part of their membership (non-transferrable).

Guild Membership Options:

Legacy Guild Annual Membership - One-Time Gift:

- Choosing your one-time membership will pay the fees immediately by credit card or EFT.

Sustained Guild Membership - Monthly Gifts:

- Should you like to spread your membership over 12 months of equal investments, please select the Monthly Sustained Giving section of the form to make your gift.

Church Guild Membership:

- Should you like to purchase a membership on behalf of your church, please select the Church Guild Membership section to select your guild level. The membership will include an invite for one of your church's pastors with guest to attend the VIP Legacy Guild event and the Spring Legacy Gala.

Join a LEGACY GUILD HERE

A sustained gift of ANY amount shows a vote of confidence and belief in our mission.

Monthly giving is one of the best gifts you can give the MISSION of CVCS. While a one-time gift is absolutely appreciated, monthly giving offers the school the advantage of applying funds where they are needed most, when they are needed most, as opportunities arise to enhance the student experience.

Sustained Monthly Gift:

Use the Monthly Sustained Giving section of the form below to make your gift disbursed over 12 months. Please consider this option as it helps the school be able to say “YES” as requests and opportunities arise to enhance students' educational experience.

Give your Sustained Giving gift today

Become a part of something that could change EVERYTHING!

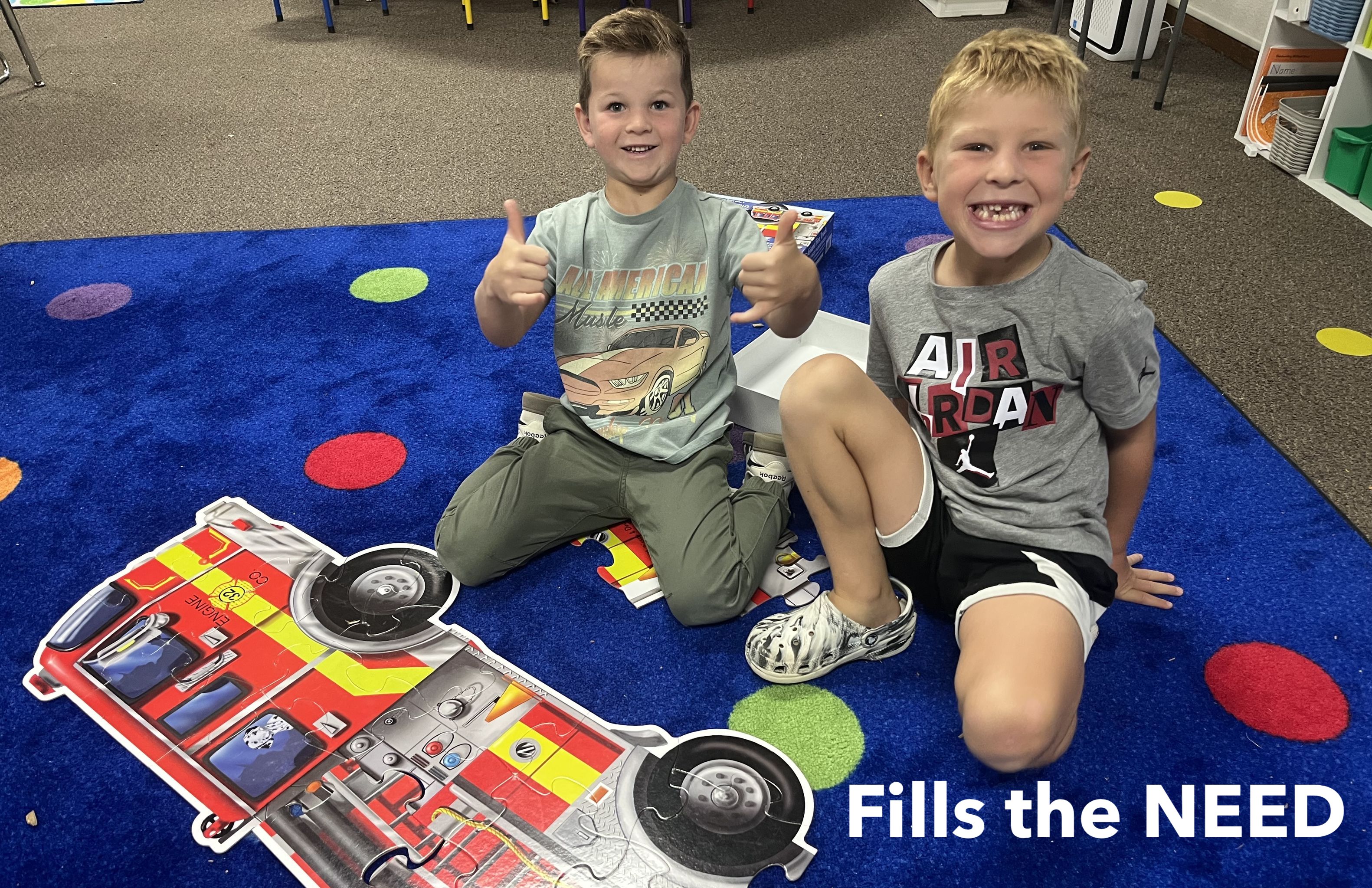

Even small gifts make a huge difference as we come together to provide for our staff, students, coaches, facilities, and programs. We are grateful for your partnership as we seek to prepare students to impact the world for Christ.

Every donation makes a difference, no matter the size!

Our goal is that everyone participates as God leads

Why? As a high percentage of our staff, board, families, and alumni participate, it shows the world that we believe in our mission and attracts others to join us by investing in our students and staff.

One-Time Gift Options:

Personal Gift:

- A one-time gift of any size will be processed immediately upon submission of this form by either credit card or EFT (Electronic Funds Transfer).

Tribute Gift:

- Should you wish to contribute to the CVCS Excellence Fund in the name of a loved one, please select the Tribute Gift section and let us know the name of your loved one on whose behalf you are making the gift. Names of Tributes will be listed in our CVCS Excellence Fund recognition (unless anonymity is requested).

Give your One-Time gift to the CVCS Excellence Fund today

Excellence Fund FAQ's

See some of the most asked questions pertaining to the Excellence Fund. Should you have additional questions please contact our development team at 208-794-1212 x 504

Get your Excellence Fund Questions answered HERE

Donation Methods

Online

Use our secure online donation form (click here).

By Mail

You may mail gifts to:

Cole Valley Christian Schools

Attn: Annual Fund

200 E. Carlton Ave

Meridian, ID 83642

Please note: current year's gifts must be postmarked 12/31.

Stop by the School

Business Office Hours - Secondary Campus

Monday-Friday | 8am-4pm

CVCS has a new Tax ID: 86-2425049

CONTACT US:

Wayde Hamby, Director of Development: wayde.hamby@cvcsonline.org

Bret Moehlmann, CFO

Cole Valley Christian Schools is a nonprofit organization operating with recognition of tax-exempt status by the IRS.

Gifts can qualify for the Idaho Educational Tax Credit. Check with your tax consultant to see how you qualify.

GIFT POLICY and PLEDGE FORMS:

Bequest Form - Confidential Letter of Intent

.jpg)

In our complicated world, we desire to have the safest campus to ensure students are mentally freed up to focus on learning. We have a dedicated Safety Director who strategizes the tools and team needed to secure our campuses. Your donation to the Excellence Fund supports the need in this important endeavor.

In our complicated world, we desire to have the safest campus to ensure students are mentally freed up to focus on learning. We have a dedicated Safety Director who strategizes the tools and team needed to secure our campuses. Your donation to the Excellence Fund supports the need in this important endeavor. Our coaches have an incredible impact on our students as they train discipline, sportsmanship, character, teamwork, and tenacity into their athletes. The costs associated with these important life lessons is well above what sports fees alone can cover. Your gift to the Excellece Fund helps us equip the coaches with the tools they need to run their important programs, including the facility upgrades to enhance their programs.

Our coaches have an incredible impact on our students as they train discipline, sportsmanship, character, teamwork, and tenacity into their athletes. The costs associated with these important life lessons is well above what sports fees alone can cover. Your gift to the Excellece Fund helps us equip the coaches with the tools they need to run their important programs, including the facility upgrades to enhance their programs. Our band, choir, theater and visual arts departments build meaningful relationships with students as they hone their craft in the arts. The instruments, stagecraft, costuming/uniforms, and sound equipment necessary to best support these endeavors require funds. Your gift to the Excellence Fund allows us to meet those needs as our creative instructors dream up the next impressive concert, musical, or play to stretch the talents of our students to their potential, including facility upgrades to enhance their programs.

Our band, choir, theater and visual arts departments build meaningful relationships with students as they hone their craft in the arts. The instruments, stagecraft, costuming/uniforms, and sound equipment necessary to best support these endeavors require funds. Your gift to the Excellence Fund allows us to meet those needs as our creative instructors dream up the next impressive concert, musical, or play to stretch the talents of our students to their potential, including facility upgrades to enhance their programs. Missional Giving through a commensurate ongoing gift to CVCS is part of building the kingdom as we educate and prepare leaders who prioritize biblical truth and values.

Missional Giving through a commensurate ongoing gift to CVCS is part of building the kingdom as we educate and prepare leaders who prioritize biblical truth and values.  Gifts to the Cole Valley Excellence Fund provide support for operations, programs, and advancements that strengthen and support our mission.

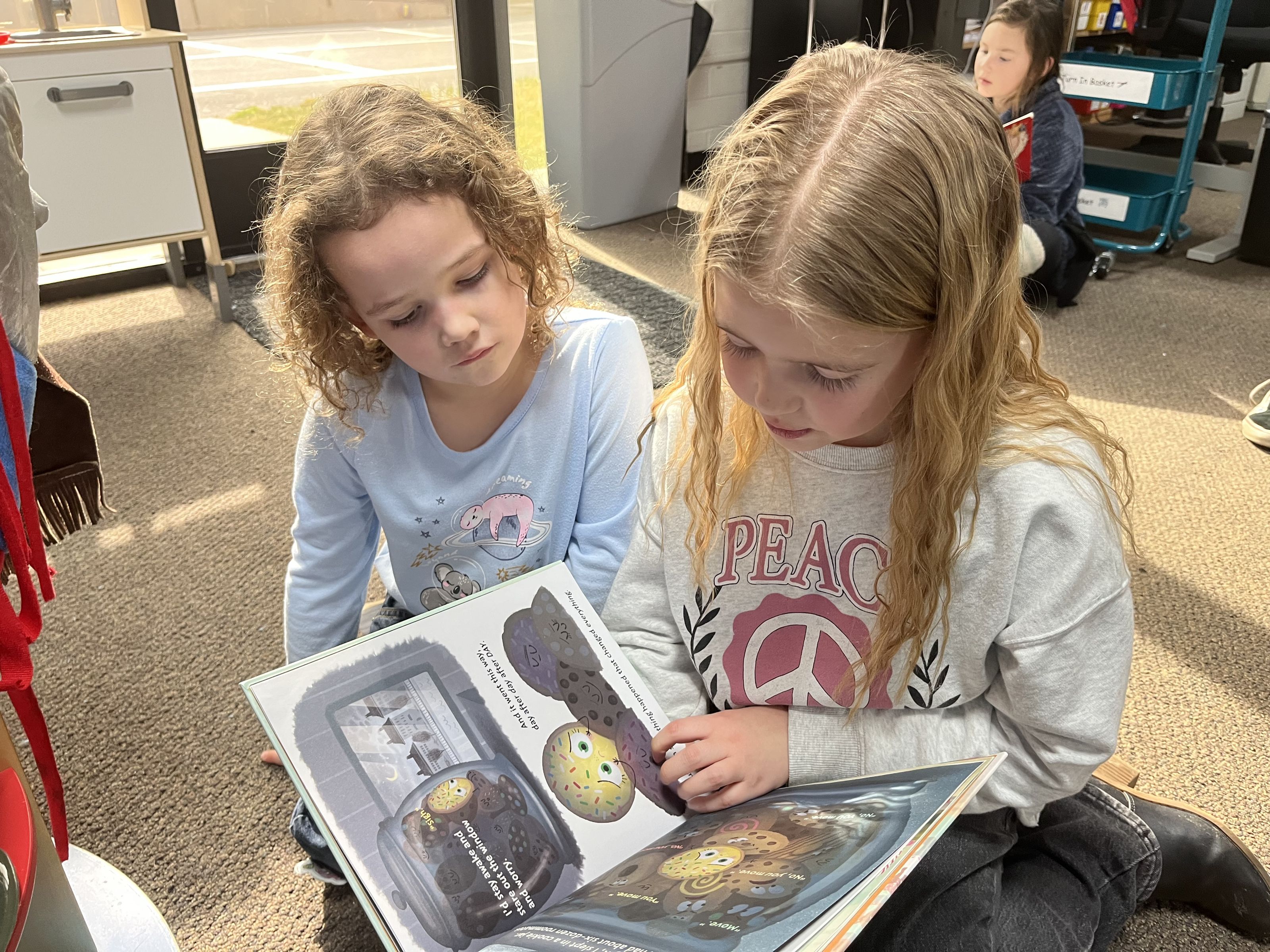

Gifts to the Cole Valley Excellence Fund provide support for operations, programs, and advancements that strengthen and support our mission. As opportunities arise, your gifts allow us to say “YES” to requests that grow excellence in all our programs. Allows your unrestricted gift to be directed to our greatest area of need as opportunities arise. It helps us provide the icing on the cake that enhances our mission above and beyond the operational needs of the school.

As opportunities arise, your gifts allow us to say “YES” to requests that grow excellence in all our programs. Allows your unrestricted gift to be directed to our greatest area of need as opportunities arise. It helps us provide the icing on the cake that enhances our mission above and beyond the operational needs of the school.  As the percentage of our constituents who participate in the Charger Fund increases, it indicates to philanthropists considering us for an investment, that those involved believe in our mission and want to see it continue long-term.

As the percentage of our constituents who participate in the Charger Fund increases, it indicates to philanthropists considering us for an investment, that those involved believe in our mission and want to see it continue long-term.